Due Diligence

Due Diligence for Mergers and Acquisitions

♦ Contractual Legal Check on Project Status.

♦ Study of Correspondence from scratch.

♦ Status of Change of Scope / Variation.

♦ Check on Extension of Time.

♦ Addressing Liquidated Damages / Penalties etc.

Due Diligence

More Questions (for Due Diligence)

Documents Attachment

1. Concession Agreement along with Schedules

2. IE MPR’s on last 6 months’ progress

3. Correspondence – Last 6 month with IE/Authority

4. Others

Documents Attachment

1. Concession Agreement along with Schedules

2. IE MPR’s on last 6 months’ progress

3. Correspondence – Last 6 month with IE/Authority

4. Others

Pre-Acquisition Negotiations– Do not overpay for a purchase. Look at the engine room first –

Before negotiating to purchase a Project company, Technical Due Diligence will help you identify whether you are paying the right price and give you a better idea how the Project company might perform in the future.

Technical Due Diligence can also help a purchaser reduce the offer price of the acquisition.

The Due Diligence should be instantly self-financing and provide with a qualitative overview of the Business, future performance complementing financial data analysis that reveals more of a current and historical view.

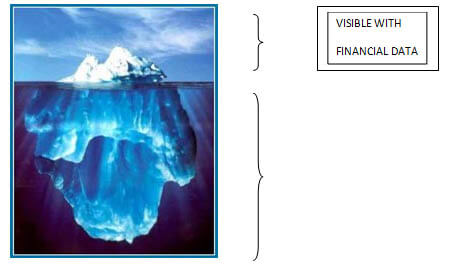

Discover what is below the water line – and not at first visible Financial Data –

The Technical & Financial Due Diligence outline content shows you what is below the water line:

- Structure

- Human Assets Analysis

- Systems Operations, Logistics, Sales and Marketing and Customer Service performance

- Market Cap Advantage versus Competitors and Lead Advantage Position

- Competitive Edge

- Human Assets, Systems and Market Cap Advantage versus Key Direct Competitors

- Scope and Future Positioning

- Margin protection feasibility study

- Brand Health and Reputation

- Brand Reviews

- Risk Future Proofing

- CSR and Community Engagement Measures

- Overseas Market Entry Positioning

- Global Market Growth Opportunity Analysis

- Location Analysis to reduce overheads so as to sustain optimal growth

- Capability

- Test Selling and Test Marketing

- Pre-Qualify and Re-Affirm Financial Success Metrics

- Profitable Sustainable Customer Focus

- New Revenue Stream Discovery

Alongside Corporate Finance team or management, we can tailor make on site visit(s) in line with your specific target objectives.

Services Undertaken

♦ Cost-to-Complete for Budgetary provisions.

♦ Inventory of Claims status.

♦ Availability of complete documents since Tender stage.

♦ Check on proper Physical and Financial progress reports.

♦ Analysis through Financial Models.

♦ Land Acquisition status.

♦ Liabilities and Assets records.

♦ NCR’s status.

♦ Design and Drawings status.

♦ Review of Monthly Progress Reported by Independent Engineer/Authority Engineer.

♦ Status of PCOD / COD.

♦ Techno Economic Viability analysis.